What are bookkeeping services?

" alt="">

" alt="">

" alt="">

" alt="">

In today’s fast-paced business world, accurate financial management is crucial for success. At the heart of this financial management lies bookkeeping – a fundamental process that forms the backbone of a company’s financial health. While often overlooked, professional bookkeeping services play a pivotal role in maintaining order, ensuring compliance, and providing valuable insights for informed decision-making.

Professional bookkeeping encompasses a wide array of tasks and responsibilities, each contributing to a comprehensive financial picture of an organization. From recording daily transactions to preparing financial statements, bookkeepers are the unsung heroes who keep businesses on track financially.

This post aims to demystify the world of professional bookkeeping by providing a detailed breakdown of the various tasks involved. Whether you’re a small business owner considering outsourcing your bookkeeping or an aspiring financial professional, understanding these key components will give you valuable insights into the importance and complexity of this critical business function.

By the end of this article, you’ll have a clear understanding of what professional bookkeeping entails, the skills required, and how it contributes to the overall success of a business. Let’s dive into the essential tasks that make up the world of professional bookkeeping.

Tracking Income and Expenses

![]()

One of the fundamental responsibilities of professional bookkeeping is the meticulous tracking of income and expenses. This task forms the foundation of a company’s financial records and is crucial for several reasons:

Accurate Financial Picture: Tracking every dollar that comes in and goes out provides a clear and accurate snapshot of a business’s financial health. This transparency is essential for making informed decisions about the company’s future.

Tax Compliance: Proper record-keeping ensures that businesses can accurately report their income and claim legitimate expenses during tax season, potentially saving money and avoiding legal issues.

Cash Flow Management: By monitoring income and expenses, businesses can better manage their cash flow, ensuring they have enough funds to cover operational costs and invest in growth opportunities.

Bookkeepers employ various methods to record financial transactions

Double-Entry Bookkeeping: This system records each transaction in at least two accounts, maintaining the balance between debits and credits. It helps catch errors and provides a more comprehensive view of the company’s finances.

Categorization: Transactions are categorized into specific accounts (e.g., sales revenue, office supplies expense) to provide detailed insights into different aspects of the business.

Chronological Order: Transactions are recorded in the order they occur, creating a clear timeline of the company’s financial activities.

To efficiently track income and expenses, bookkeepers utilize a range of tools and methods:

Accounting Software: Programs like QuickBooks, Xero, or FreshBooks automate much of the recording process and provide real-time financial reports.

Receipt Management Apps: These apps allow for quick digitization and categorization of receipts, streamlining expense tracking.

Bank Feed Integration: Many modern accounting systems can directly import transactions from bank accounts and credit cards, reducing manual data entry.

Spreadsheets: While less common in professional settings, spreadsheets can still be useful for smaller businesses or specific tracking needs.

To illustrate the benefits of accurate tracking, consider this example:

A small retail business owner noticed a significant increase in utility expenses over several months. Thanks to detailed expense tracking, they were able to pinpoint the cause: an old, inefficient HVAC system. This insight led them to invest in a new, energy-efficient system. While this required an upfront cost, the long-term savings in utility expenses significantly improved the company’s profitability. Without accurate expense tracking, this opportunity for cost-saving might have been overlooked.

By maintaining precise records of income and expenses, bookkeepers provide businesses with the data they need to make informed decisions, optimize operations, and drive growth.

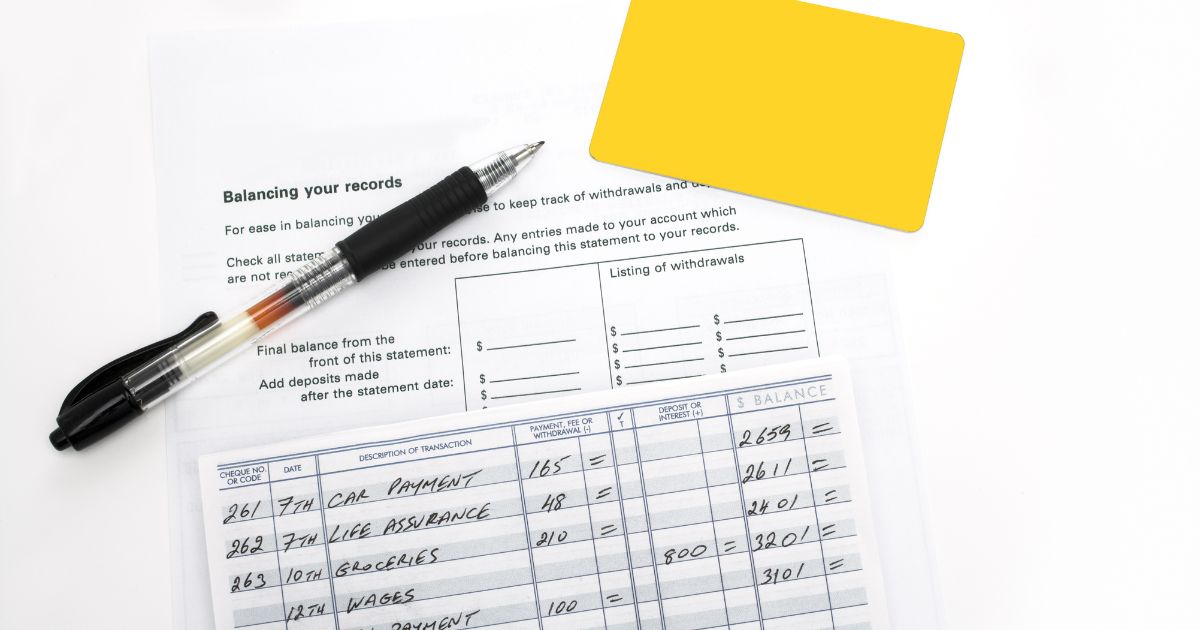

Bank Reconciliation

Bank reconciliation is a critical process in professional bookkeeping that ensures the accuracy of a company’s financial records. It involves comparing the company’s internal financial records with the statements provided by the bank to identify and resolve any discrepancies.

Definition and Importance: Bank reconciliation is the process of matching the balances in an organization’s accounting records for a cash account to the corresponding information on a bank statement. This process is crucial for several reasons:

- It helps detect errors in either the company’s records or the bank’s records.

- It identifies any unauthorized transactions or fraudulent activities.

- It ensures that all transactions are accounted for and recorded correctly.

- It provides an accurate picture of the company’s cash position.

Steps Involved in the Bank Reconciliation Process

- Gather necessary documents: Collect the bank statement and the company’s cash book or ledger for the period in question.

- Compare the opening balances: Ensure the opening balance on the bank statement matches the previous reconciliation’s closing balance.

- Mark off matching transactions: Go through each transaction in the cash book and mark those that appear on the bank statement.

- Identify outstanding items: Note any transactions in the cash book that don’t appear on the bank statement (e.g., checks not yet cleared).

- Identify bank entries: Note any entries on the bank statement that aren’t in the cash book (e.g., bank fees, interest earned).

- Adjust the cash book: Record any previously unrecorded items found on the bank statement in the cash book.

- Prepare a reconciliation statement: List all differences between the cash book and bank statement, showing how the two balances can be reconciled.

- Update the general ledger: Make necessary adjustments in the company’s general ledger based on the reconciliation findings.

Common Issues and Resolutions

- Outstanding checks: These are checks issued but not yet cashed. They’re recorded in the company’s books but not yet reflected in the bank statement. Resolution: Keep track of these items and follow up on long-outstanding checks.

- Bank fees: Banks often deduct fees directly from the account. Resolution: Ensure these are recorded in the company’s books.

- Deposits in transit: These are amounts received and recorded by the company but not yet processed by the bank. Resolution: Verify that these deposits appear on the next bank statement.

- Errors: Occasionally, either the company or the bank may make recording errors. Resolution: Investigate discrepancies and correct errors in the company’s records or contact the bank to resolve their errors.

Benefits of Regular Bank Reconciliation:

- Financial Accuracy: Regular reconciliation ensures that the company’s financial records are accurate and up-to-date, providing a true picture of the company’s cash position.

- Fraud Prevention: By regularly comparing records, any unauthorized transactions or fraudulent activities can be quickly identified and addressed.

- Better Cash Management: Accurate knowledge of available funds helps in making informed decisions about cash flow and investments.

- Error Detection: It helps catch and correct errors in a timely manner, preventing small issues from becoming larger problems.

- Audit Preparation: Regular reconciliations make audits smoother by ensuring financial records are accurate and discrepancies are explained.

- Compliance: Many regulatory bodies require regular bank reconciliations as part of maintaining proper financial records.

By performing regular and thorough bank reconciliations, bookkeepers play a crucial role in maintaining the financial integrity of a business, preventing fraud, and ensuring accurate financial reporting.

Payroll Management

Payroll management is a critical function within professional bookkeeping services, playing a vital role in ensuring employees are paid accurately and on time while maintaining compliance with various legal and tax requirements.

Overview and Importance: Payroll management involves the administration and processing of employee compensation, including salaries, wages, bonuses, deductions, and withholdings. It’s crucial for businesses for several reasons:

- Employee Satisfaction: Timely and accurate payments are essential for maintaining employee morale and trust.

- Legal Compliance: Proper payroll management ensures adherence to labor laws and tax regulations.

- Financial Planning: It provides accurate data for budgeting and financial forecasting.

- Business Reputation: Efficient payroll management contributes to a company’s professional image.

Tasks Involved in Payroll Management:

- Calculating Wages: This involves computing regular hours, overtime, bonuses, and any other forms of compensation.

- Withholding Taxes: Bookkeepers must calculate and deduct the correct amount of federal, state, and local taxes from each employee’s paycheck.

- Managing Deductions: This includes processing deductions for benefits such as health insurance, retirement plans, and other employee-elected deductions.

- Issuing Payments: Distributing paychecks or managing direct deposits to employees’ bank accounts.

- Maintaining Records: Keeping detailed records of all payroll transactions, employee information, and tax filings.

- Generating Reports: Creating payroll reports for management, auditors, and government agencies.

- Year-End Processes: Preparing and distributing W-2 forms, filing annual tax returns, and reconciling payroll accounts.

Compliance with Legal and Tax Requirements

Payroll management involves navigating a complex landscape of regulations:

- Fair Labor Standards Act (FLSA): Ensures compliance with minimum wage, overtime pay, recordkeeping, and youth employment standards.

- Federal and State Tax Laws: Requires correct calculation and timely remittance of income tax withholdings, Social Security, and Medicare contributions.

- State-Specific Requirements: Many states have their own labor laws and tax regulations that must be followed.

- Affordable Care Act (ACA): For applicable businesses, this involves tracking and reporting on employee health insurance offerings.

- Equal Employment Opportunity Commission (EEOC) Regulations: Ensures non-discriminatory pay practices.

How Professional Bookkeeping Services Ensure Accurate and Timely Payroll Processing

- Utilizing Specialized Software: Professional bookkeepers use advanced payroll software that automates calculations, tax withholdings, and report generation, reducing the risk of errors.

- Staying Updated on Regulations: Bookkeeping services invest in ongoing education to stay current with changing tax laws and labor regulations.

- Implementing Internal Controls: They establish checks and balances to verify payroll data and catch potential errors before processing.

- Offering Customized Solutions: Professional services can tailor payroll processes to meet the specific needs of different businesses, such as handling multiple pay rates or complex benefit structures.

- Providing Expertise in Tax Filings: They ensure accurate and timely submission of required tax forms and payments to relevant authorities.

- Conducting Regular Audits: Periodic internal audits help identify and correct any discrepancies in payroll records.

- Ensuring Data Security: Professional services implement robust security measures to protect sensitive employee and payroll information.

- Offering Employee Self-Service Options: Many bookkeeping services provide platforms where employees can access their pay stubs, tax forms, and update personal information, reducing administrative burden.

By leveraging professional bookkeeping services for payroll management, businesses can ensure compliance, accuracy, and efficiency in this critical area of operations. This not only saves time and reduces the risk of costly errors but also allows business owners and managers to focus on core business activities while having peace of mind about their payroll processes.

Managing Accounts Receivable and Accounts Payable

Effective management of accounts receivable (AR) and accounts payable (AP) is crucial for maintaining healthy cash flow and financial stability in any business. Professional bookkeeping services play a key role in overseeing these critical aspects of financial management.

Explanation of Accounts Receivable (AR) and Accounts Payable (AP):

Accounts Receivable (AR) refers to the money owed to a company by its customers for goods or services provided on credit. It represents future incoming cash flow.

Accounts Payable (AP) is the amount a company owes to its suppliers or vendors for goods or services received but not yet paid for. It represents future outgoing cash flow.

Process of Managing Accounts Receivable

Invoicing:

Creating accurate and timely invoices for goods or services provided

Ensuring invoices include all necessary details (e.g., payment terms, due dates)

Sending invoices promptly to customers

Tracking Payments:

Recording incoming payments and associating them with the correct invoices

Updating AR balances in the accounting system

Reconciling AR accounts regularly

Following Up on Overdue Accounts:

Monitoring aging reports to identify overdue payments

Sending reminders or statements to customers with outstanding balances

Implementing a structured follow-up process for late payments

Negotiating payment plans when necessary

Credit Management:

Establishing credit policies and limits for customers

Conducting credit checks on new customers

Regularly reviewing and adjusting credit terms based on payment history

Process of Managing Accounts Payable

Tracking Bills:

Receiving and recording all incoming invoices from suppliers

Verifying the accuracy of invoices against purchase orders and receipts

Entering invoice details into the accounting system

Ensuring Timely Payments:

Scheduling payments based on due dates and available cash

Taking advantage of early payment discounts when beneficial

Processing payments through appropriate channels (e.g., checks, electronic transfers)

Managing Cash Flow:

Forecasting upcoming payment obligations

Balancing payment timing with expected cash inflows

Negotiating favorable payment terms with suppliers when possible

Vendor Management:

Maintaining accurate vendor information

Resolving discrepancies or disputes with suppliers

Building positive relationships with key vendors

Importance of Maintaining Healthy AR and AP Balances

Cash Flow Optimization:

Balancing incoming and outgoing cash flows helps ensure the business has sufficient working capital

Proper management prevents cash shortages or excess idle cash

Financial Planning:

Accurate AR and AP data provides insights for budgeting and forecasting

Helps in making informed decisions about investments or financing needs

Creditworthiness:

Timely payment of AP enhances the company’s credit rating and reputation with suppliers

Efficient AR collection improves the company’s financial stability

Cost Savings:

Taking advantage of early payment discounts in AP can lead to significant savings

Minimizing late payments in AR reduces the need for external financing

Relationship Management:

Prompt AR collection and AP payment foster positive relationships with customers and suppliers

Good relationships can lead to better terms, priority service, or increased sales

Financial Reporting Accuracy:

Well-managed AR and AP contribute to more accurate financial statements

Provides stakeholders with a true picture of the company’s financial position

Risk Management:

Regular monitoring of AR helps identify potential bad debts early

Proper AP management prevents missed payments and associated penalties

By effectively managing accounts receivable and accounts payable, professional bookkeeping services help businesses maintain financial health, optimize cash flow, and build strong relationships with both customers and suppliers. This balanced approach to financial management is crucial for long-term business success and stability.

Financial Reporting

Financial reporting is a critical component of professional bookkeeping services, providing businesses with invaluable insights into their financial health and performance. These reports serve as the foundation for informed decision-making and strategic planning.

Importance of Financial Reporting:

- Performance Evaluation: Financial reports allow businesses to assess their financial performance over time and compare it against industry benchmarks.

- Strategic Planning: Accurate financial data helps in formulating and adjusting business strategies based on historical performance and future projections.

- Investor Relations: For businesses with external investors, financial reports provide transparency and build trust.

- Compliance: Many businesses are required to produce regular financial reports to comply with legal and regulatory requirements.

- Credit Accessibility: Lenders and financial institutions often require financial reports to assess creditworthiness.

- Resource Allocation: Reports help identify areas of the business that are performing well or need improvement, guiding resource allocation decisions.

Types of Financial Reports Commonly Generated

Income Statement (Profit and Loss Statement):

Shows revenues, expenses, and profit/loss over a specific period

Helps assess profitability and identify areas for cost reduction or revenue growth

Balance Sheet:

Provides a snapshot of the company’s financial position at a specific point in time

Lists assets, liabilities, and owner’s equity

Useful for assessing the company’s overall financial health and solvency

Cash Flow Statement:

Tracks the inflow and outflow of cash in operating, investing, and financing activities

Critical for understanding the company’s liquidity and cash management

Accounts Receivable Aging Report:

Shows outstanding customer invoices categorized by the length of time they’ve been unpaid

Helps in managing collections and assessing credit risks

Accounts Payable Aging Report:

Lists unpaid bills to suppliers, categorized by due dates

Assists in managing cash flow and maintaining good supplier relationships

Budget vs. Actual Report:

Compares actual financial performance against the budgeted figures

Helps in identifying variances and adjusting future budgets or operations

Inventory Reports:

Tracks inventory levels, turnover rates, and costs

Essential for businesses dealing with physical goods

How Bookkeepers Compile and Analyze Financial Data

- Data Collection: Gather financial data from various sources such as bank statements, invoices, and receipts.

- Data Entry: Input collected data into accounting software, ensuring accuracy and proper categorization.

- Reconciliation: Regularly reconcile accounts to ensure all transactions are accounted for and accurate.

- Data Verification: Cross-check entries and totals to identify and correct any discrepancies.

- Report Generation: Use accounting software to generate standardized reports based on the entered data.

- Customization: Tailor reports to meet specific business needs or management requests.

- Analysis: Review reports to identify trends, anomalies, or areas of concern.

- Interpretation: Provide context and explanations for the financial data to help management understand the implications.

Frequency and Significance of Regular Financial Reporting:

- Monthly Reporting:

Provides timely insights into short-term performance

Allows for quick identification and resolution of issues

Helps in making operational adjustments

- Quarterly Reporting:

Offers a broader view of performance trends

Often required for businesses with external stakeholders

Useful for medium-term planning and strategy adjustments

- Annual Reporting:

Provides a comprehensive overview of the entire year’s performance

Essential for tax purposes and long-term strategic planning

Often required for regulatory compliance and stakeholder communication

- Ad-hoc Reporting:

Generated as needed for specific purposes (e.g., loan applications, major business decisions)

Allows for focused analysis on particular aspects of the business

The significance of regular reporting lies in its ability to:

- Provide consistent and timely information for decision-making

- Enable early detection of financial issues or opportunities

- Facilitate performance tracking against goals and budgets

- Ensure ongoing compliance with financial regulations

- Build a historical record of the company’s financial journey

By providing comprehensive and accurate financial reports, professional bookkeeping services enable businesses to maintain a clear understanding of their financial position, make informed decisions, and navigate towards their financial goals with confidence.

FAQs on bookkeeping services

Q: What is the primary purpose of bookkeeping services?

Answer: The primary purpose of bookkeeping services is to record and manage a business’s financial transactions systematically. This helps ensure accurate financial reporting, compliance with legal requirements, and informed decision-making.

Q: Why is tracking income and expenses important for my business?

Answer: Tracking income and expenses is crucial because it provides a clear picture of your business’s financial health. It helps identify profitable areas, control costs, and make informed financial decisions. Accurate tracking also ensures compliance with tax regulations.

Q: What is bank reconciliation, and why do I need it?

Answer: Bank reconciliation is the process of matching the transactions recorded in your financial records with those on your bank statement. This ensures that your records are accurate and up-to-date, helps identify any discrepancies, and prevents fraud.

Q: How does professional bookkeeping handle payroll management?

Answer: Professional bookkeeping services handle payroll management by calculating wages, withholding taxes, issuing payments, and ensuring compliance with legal and tax requirements. This ensures that employees are paid accurately and on time, and that your business meets all regulatory obligations.

Q: What are accounts receivable (AR) and accounts payable (AP), and why are they important?

Answer: Accounts receivable (AR) refers to the money owed to your business by customers, while accounts payable (AP) refers to the money your business owes to suppliers. Managing AR and AP is important to maintain healthy cash flow, ensure timely payments, and avoid financial difficulties.

Final Thoughts on bookkeeping services

Professional bookkeepers bring expertise, efficiency, and accuracy to these crucial tasks, allowing business owners and managers to focus on core business activities with the confidence that their financial management is in capable hands.

As businesses navigate an increasingly complex financial landscape, the need for professional bookkeeping services becomes ever more apparent. Whether you’re a small startup or an established enterprise, accurate and efficient financial management is crucial for your success and growth.

We encourage you to consider the benefits of professional bookkeeping services for your business. By partnering with experienced professionals, you can ensure that your financial records are maintained with the utmost accuracy, your compliance requirements are met, and you have the financial insights needed to drive your business forward.

Take the next step towards robust financial management. Explore how professional bookkeeping services can support your business goals, provide peace of mind, and contribute to your long-term success. Your future self – and your bottom line – will thank you for making this wise investment in your business’s financial health.

This concludes our comprehensive overview of professional bookkeeping services. By understanding and leveraging these essential financial management tasks, you’re well on your way to building a stronger, more financially secure business.